Let’s define a startup before diving into the various funding stages that make up the startup industry. A startup is a business that is just getting started. In most cases, one or more entrepreneurs create startups with the intention of creating a special product or service to satisfy a need in the market. Angel or venture capitalists who see the potential for a startup to become profitable often provide funding for it.

What is Startup Funding?

Startup funding is the process where funds are given to individuals or groups of individuals for their new venture, enabling the business to expand and grow. In exchange of their investment investors get an equity of a company they invested in.

Investors establish a partnership with the companies they choose to fund; in the event that the business makes a profit, investors receive returns corresponding to the percentage of equity they own; in the event that the venture fails, investors forfeit their investment.

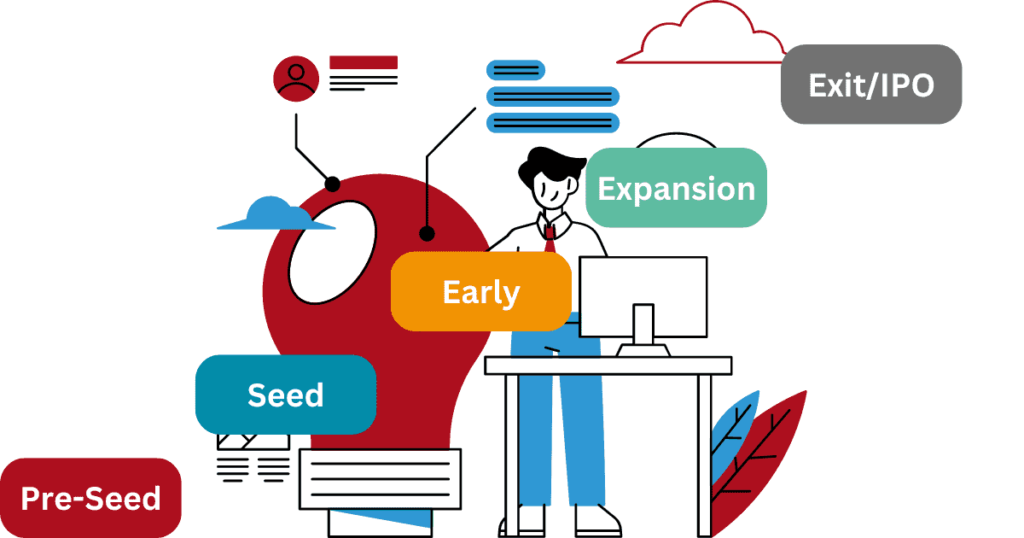

Startup Funding stages are as follows

Pre-Seed Stage

At this funding stage, the entrepreneur has a concept and is trying to make it a reality. Usually, not much money is needed at this stage. Additionally, there are extremely few routes for raising money during the initial stage in the startup lifecycle, mostly the financing for the startup is done by self financing or the funds raised from friends and family

This stage of startup also helps to identify startup’s potential success or failure by looking at existing challenges, competitors and also the need of introducing a new product/service in the market.

In Pre-Seed stage of startup analysis of the market is done and also the ground work is started

Seed Stage

At this funding stage, a startup has a prototype ready and needs to validate the potential demand of the startup’s product/service. This is called conducting a ‘Proof of Concept (POC)’, after which comes the big market launch.

This phase is when your startup’s equity fundraising officially starts. That’s important because even if you have the greatest concept your industry has ever seen, it won’t matter if you don’t have the funding to back it.

In the seed stage, capital becomes critical, therefore you’ll need to look outside of your social circle for support. Angel investors, crowdsourcing platforms, and incubators are some possible sources of funding for seed-stage startups.

Early Stage

This funding stage is also called as “Series A.” round in startup funding

At the Early stage startup’s products or services have been launched in the market. Key performance indicators such as customer base, revenue, app downloads, etc. become important at this stage. once the startup has achieved this it can move to early stage or Series A round

In the Series A stage, it’s essential to have a business plan that will generate long-term profits. and the capital raised in this funding stage to further grow the user base, product offerings, expand to new geographies, etc. Common funding sources utilized by startups in this stage are: Venture Capital Funds, NBFCs, Venture Debts

Expansion Stage

At this funding stage, the startup is experiencing a fast rate of market growth and increasing revenues. Now that you’ve proven market demand for your product or service, you’ve set your sights on further scaling operations.

Many people will no longer consider your business a startup. With the greater market in mind, your goal is to expand further.

Common funding sources utilized by startups in this funding stage are: Venture Capital Funds, Private Equity/Investment Firms

Exit/IPO Stage

Best wishes! If you’ve made it this far, your startup has grown to be a successful business.

There’s a good chance that people no longer view your company as a startup. At this point, your business is well-known within the industry, with a proven track record for products or services, a loyal customer base, and a fully staffed team

This stage is optional and is oftentimes presented to founders naturally. and mainly 3 ways for the exit is sell founders share to the VC, Merger and Acquisitions, IPO Initial Public Offering

FAQs

What are the stages of startup financing?

The five stages of startup financing are Pre-Seed Stage, Seed Stage, Early Stage, Expansion Stage, Exit/IPO Stage

What is the Last stage of funding?

Initial Public Offering (IPO) is the last funding stage. Here, the company goes from a private entity to a public entity

Paytm is in which funding stage?

As Paytm is listed in Indian Stock Market It is not in any of the funding stages it has been listed in the market